How to Configure Risk Management

In Forex or Stock trading risk management is the process of identifying, assessing, and mitigating the various risks associated with trading, these risks can significantly impact your trading capital, and effective risk management is crucial to protect your investments and achieve long-term success in the forex market.

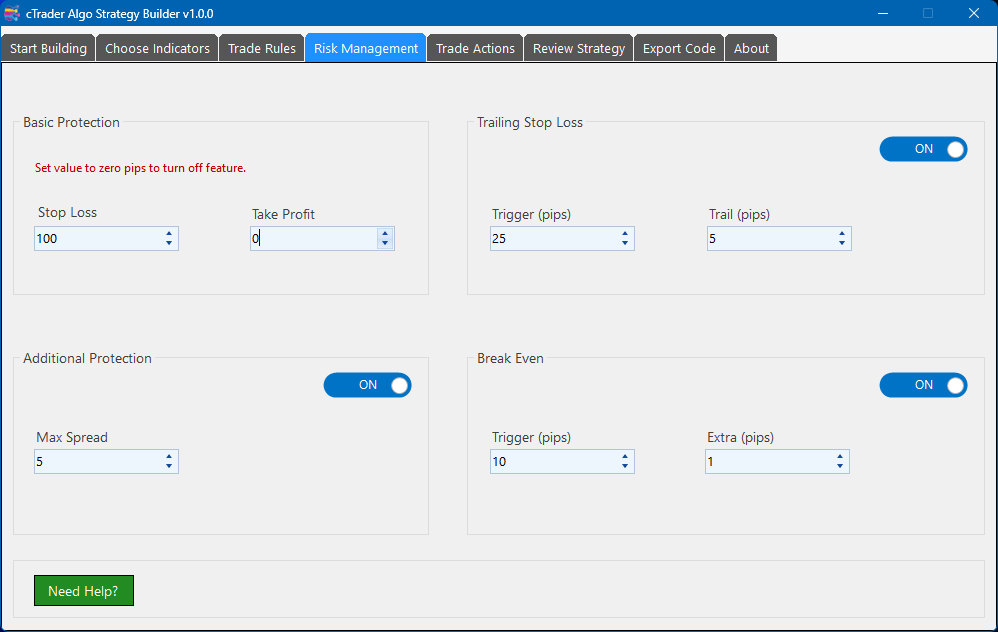

This version of the Algo Strategy Builder has some basic risk management to help you protect your money:

- Stop loss protection.

- Take profit.

- Trailing Stop Loss with trigger and trailing step.

- Max Spread protection.

- Break Even with trigger and extra profit.

Basic Protection

The basic protection provides a fixed stop loss in pips to protect your capital, if your trade starts losing then you will lose only what you have planned to lose. You can also set a fixed take profit in pips, so when the price reached this level the trade closes in profit.

You can disable the stop loss or take profit by setting the value to zero (0), this will mean that when a trade opens it will have no stop lose or take profit protection. Some traders prefer this so they can manually manage their positions and avoid markets swings that will hit a stop loss.

Trailing Stop Loss

A trailing stop loss order is a trading tool commonly used in Forex and stock markets where it sets a stop loss price at a specific distance, typically measured in pips, either above or below the current market price. The unique feature of a trailing stop loss is that it adjusts itself as the market price moves in a favorable direction.

This feature can be turned on or off via the toggle switch, if turned on then when the price in pips from the entry price reaches the value set in pips a stop loss will be placed (x) pips behind the price (trail).

Break-Even Stop

A breakeven stop loss, also known as a breakeven point or breakeven stop, is a type of stop loss order in trading that is designed to protect the trader's initial investment. It works by adjusting the stop loss price to the trader's entry point or a price level where they have locked in profits equal to their initial investment, so when the market price reaches this breakeven point, the stop loss order is triggered, closing the trade at the trader's entry price, ensuring they don't incur any further losses and preserving their initial capital.

This feature can be turned on or off via the toggle switch, if turned on then when the price in pips from the entry price reaches the value set in pips a stop loss will be placed at the entry price plus some extra pips, usually enough to cover the spread and fees.

Additional Protection

This feature can be turned on or off via the toggle switch, if turned on then no trade will open if the symbol spread is higher than the value set. This is very useful when there is a major news event or when there is low liquidity and the spread of a symbol widens, if this happens your stop loss could be taken out at a loss as soon as the trade is placed.

In Forex (foreign exchange) trading, the "spread" refers to the difference between the bid price and the ask price of a currency pair. The bid price is the highest price a buyer is willing to pay for a particular currency pair, while the ask price is the lowest price at which a seller is willing to sell the same currency pair.