NinjaTrader Account Locking

The Risk Management Tool we offer will block trading due to certain conditions, but the user can still restart NinjaTrader in the event of a critical condition and still manage their trades. The NinjaTrader team do not recomend that a 3rd party vendor should block a traders activity that could lead to the user being unable to manage their account in a critical situation.

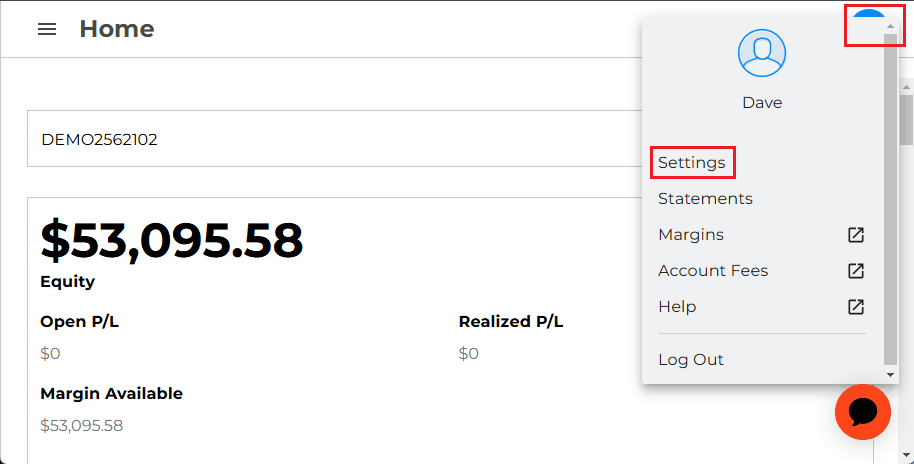

NinjaTrader Account Risk Settings Offers Account Lockout's

You can turn on account level loss limits which prevent you from trading if you hit a certain loss amount. If you use a NinjaTrader account that is found on the account settings page.

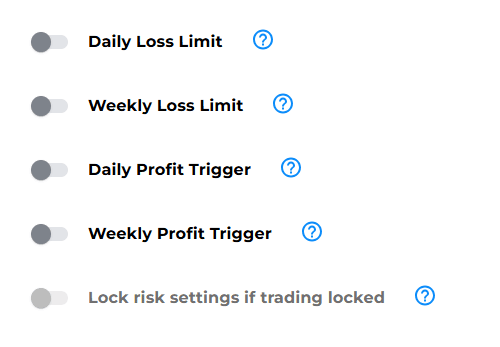

Profit & Loss Triggers

You can set limits to ensure the account is automatically liquidated and locked on a "not held" basis once the limit is reached. The account will unlock at the end of the session, or it can be "unlocked" at any time by either increasing the limit or disabling it. If NinjaTrader’s standard risk rules are more restrictive than your specified parameters, NinjaTrader’s rules will take precedence.

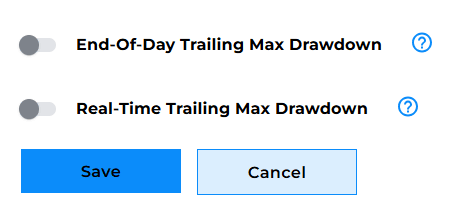

Drawdown Triggers

You can configure either an end-of-day drawdown limit that will stop further trading or a real-time drawdown lock-out that will prevent further trading when you current drawdown reaches the threshold you have set.

OverTrading

Overtrading can be caused by a variety of factors, both psychological and strategic, with emotional trading, traders can lose due to Greed, Fear of Missing Out (FOMO) and Revenge Trading. There are other factors like, Lack of Discipline, Insufficient Knowledge, Poor Risk Management, Market Conditions and Broker Incentives.